HONG KONG (Reuters) – Asian hedge funds tiptoed back into the market last week, adding to their positions in Japan and India shares, after quickly cutting exposure when U.S. President Donald Trump unleashed sweeping tariffs at the start of the month, Morgan Stanley said.

They were also buyers in Taiwan, mainly driven by short coverings, but reduced positions in Australia and China, the prime brokerage note sent to clients on Tuesday shows.

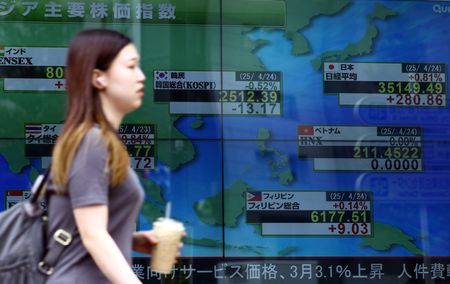

Japan and India stood out when global investors struggled to find cover amid the market turmoil and a loss in confidence in U.S. assets.

Japan’s benchmark Nikkei 225 has already recovered all the losses since Trump unveiled his “Liberation Day” tariffs on April 2, and is slightly up this month; Indian stocks were among the first in the world to bounce back from losses, with the NIFTY 50 rising more than 3% this month.

Investors are betting on these countries to successfully negotiate a trade deal with the United States after the Trump administration’s 90-day pause on tariffs for most countries except China.

Hedge funds snapped up materials, tech, and industrials shares in Japan, Morgan Stanley said, but in China, they mainly sold or added bearish bets against consumer discretionary stocks.

Washington raised tariffs on China to 145% in April, prompting China to retaliate with 125% levies on U.S. imports, escalating a trade war between the world’s two largest economies.

Economists believe the macro data in China will show weakness in the second quarter due to trade war damage.

A separate note by Goldman Sachs showed Chinese equities led the net selling flow by hedge funds in Asia for the month until April 24. The selling was focused on Hong Kong and U.S.-listed Chinese shares.

Although Asian hedge funds’ leverage level is recovering, it is still “far below pre-tariff selloff levels”, Morgan Stanley said.

(Reporting by Summer Zhen; Editing by Shri Navaratnam)

Brought to you by www.srnnews.com