(The Center Square) – There is another push for a larger portion of Illinois income taxes to go back to municipalities.

The Local Government Distributive Fund is made up of income tax collections and supports a city’s public works, and police and fire departments. Initially in 1969, a city’s portion was 10%, but it now sits at just over 6.4%.

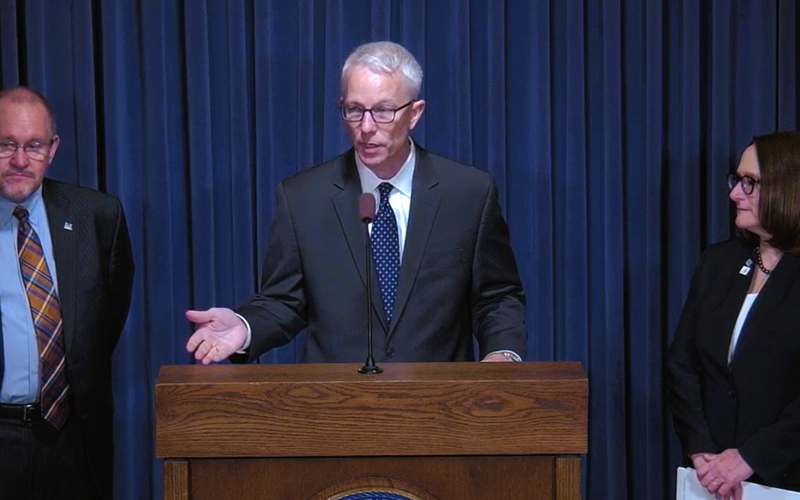

During a news conference Tuesday, the Illinois Municipal League announced their “Moving Cities Forward” agenda and called for the restoration of the LGDF to 10%. CEO Brad Cole said the increase should be included in the next state budget.

“The difference is about a billion dollars a year, so if you look at some of the things that state funds have been spent on in recent years, that is being paid for on the backs of residents of communities who are not getting the full share of LGDF,” Cole said.

Several mayors have expressed support for legislation from state Rep. Anthony DeLuca, D-Chicago Heights, that would gradually restore the share local governments receive. DeLuca has made similar attempts in the past but the bills never made it to the floor for a vote.

“Certainly the money is necessary, otherwise we have to increase taxes and fees on other services to help cover some of those expenses because those items on infrastructure, they don’t go away,” said Mark Kupsky, mayor of Fairview Heights and president of the IML.

The IML is also backing legislation that grants authority to fulfill public notice mandates electronically, grants re-amortization of downstate public safety pension funds, and gives local governments the authority to conduct remote meetings.

Gov. J.B. Pritzker will deliver his annual budget address next week.