(The Center Square) — Iowans will keep more of their money in their pockets in 2024.

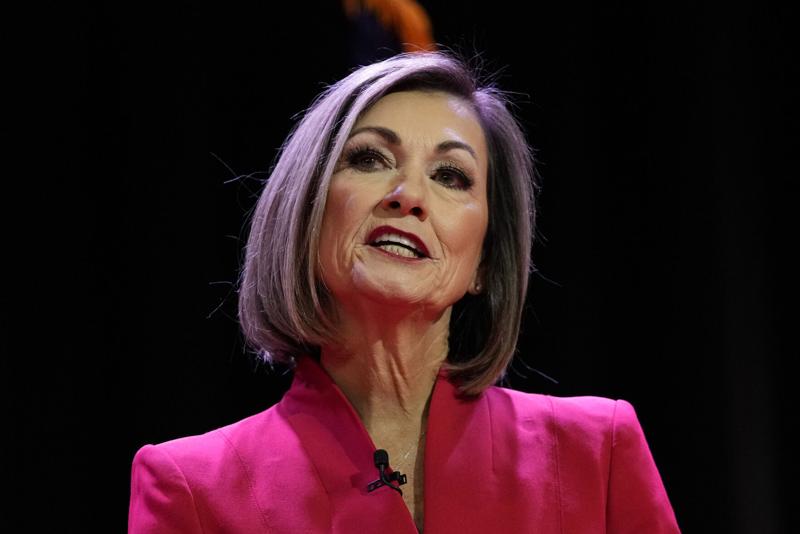

The state’s top marginal income tax rate will roll back Jan. 1, 2024, from 6% to 5.7%. Gov. Kim Reynolds said in September more are likely when lawmakers convene in January. The state ended fiscal year 2023 with a $1.83 billion surplus.

“Some see a surplus as government not spending enough, but I view it as an over collection from the hard-working men and women of Iowa,” Reynolds said. “We’ve seen what the powerful combination of growth-oriented policies and fiscal restraint can create, and now it’s time for Iowans to directly receive the benefits. I look forward to cutting taxes again next legislative session and returning this surplus back to where it belongs — the people of Iowa.”

The income tax cuts signed by Reynolds in 2022 are a step toward a 3.9% flat income tax rate by 2026.

The corporate tax rates will drop from 8.4% to 7.1% for businesses with more than $100,000 in income. Companies with less than $100,000 in revenue will pay 5.5%.

Lawmakers also slashed the inheritance tax from 4% to 2% and the franchise tax from 4.7% to 4.4% beginning in 2024.

These are the second round of tax cuts enacted by Reynolds in the legislature. Last year’s cuts returned $561 million to the taxpayers but did not hurt the state’s financial position, the Revenue Estimating Conference said earlier this month.

No adjustments are needed to the fiscal year 2024 budget, according to Committee Chair Kraig Paulsen. The general fund revenue for Iowa is projected at $9.6 billion for fiscal year 2025, according to the committee.

Iowa lawmakers return to Des Moines for the 2024 legislative session on Jan. 8. Reynolds will address the Legislature on Jan. 9.